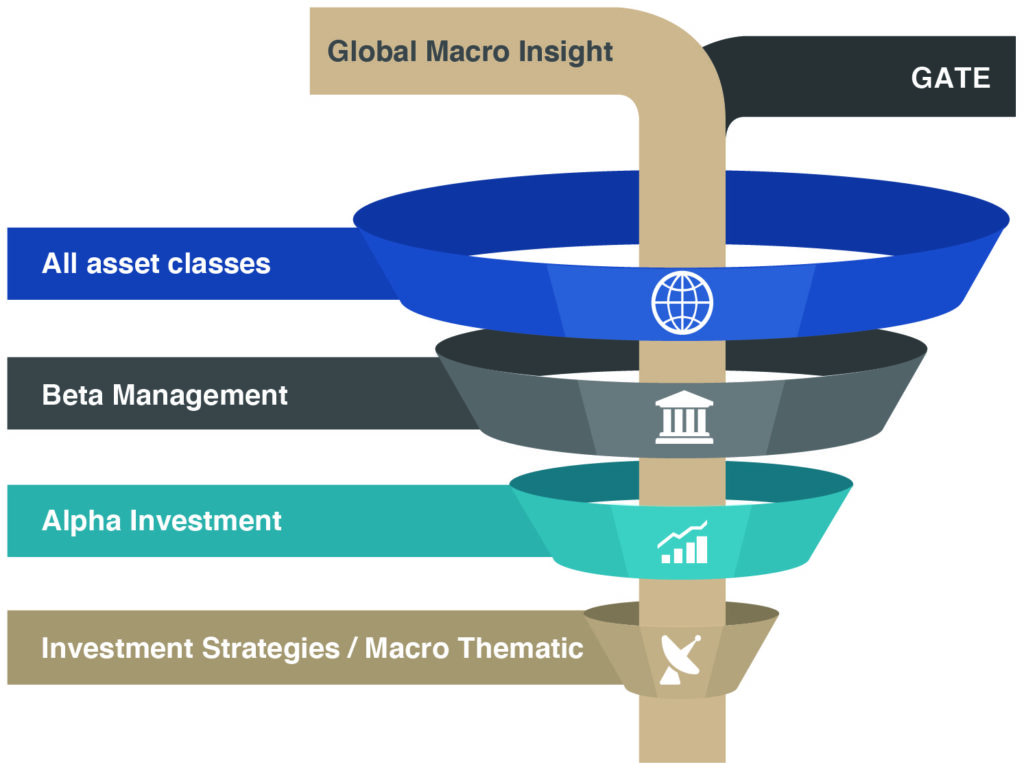

About GATE – Our Approach

Global Macro & Quantamental as foundations

GATE Advisory is a 2.0 investment partner.

The core process is pure Quantamental Global Macro. Investment, and not trading, is the purpose.

In our portfolio construction research, we articulate strategies together, and fully integrating the risk dimension at all stages.

GATE aggregates directional and relative value positionings.

Quantamental, what does it mean?

Quantamental combines two types of investment strategies, quantitative and fundamental. Quantitative investing generally uses PhDs with complex algorithms, large computer systems and lots of data to invest in many asset classes. Fundamental investing uses analysis based on top-down and bottoms-up fundamentals.

In a few words, Quantamental Approach merges Quantitative Analysis, AI, and Fundamental Research. Our fundamental approach allows Quantilia to build us quantitative analysis including data mining, NLP (Natural Language Processing), and other artificial intelligence processes.

How does quantitative investing work?

- Integrates emerging quantitative-based AI approaches with a fundamental understanding/appreciation of shifts in data metrics and intangibles.

- Developing strategies at the intersection of structural, statistical, and Fundamental trading – integrating quantitative and discretionary approaches across multiple asset classes and time frames.

- Automating the process of discretionary investors by integrating fundamental, macroeconomic, microeconomic and microstructure reasoning in model development.

GATE stands for Global Allocation & Tactical Expertize

GATE Advisory is dedicated to worldwide Institutional, Endowments, Family Offices, Independent asset managers, and UHNWIs. GATE is animated by a core investment process, leveraging an open-ecosystem, allowing clients to navigate through asset classes and investment styles

GATE Advisory is designed as a polymorphic research company. The GMI* expresses your Global Macro research, digesting information, helping clients to generate wisely there own asset allocations and thematic across asset classes. In addition, we may navigate through Beta and Alpha investment processes.

GMI : Global Macro Insight – a global macro daily report.