by Jacques Lemoisson | Mar 20, 2021

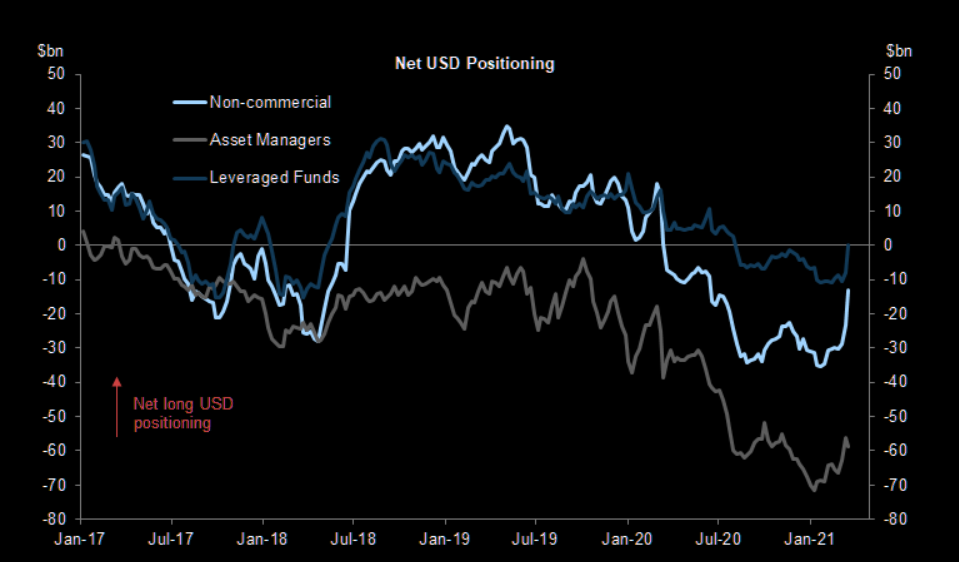

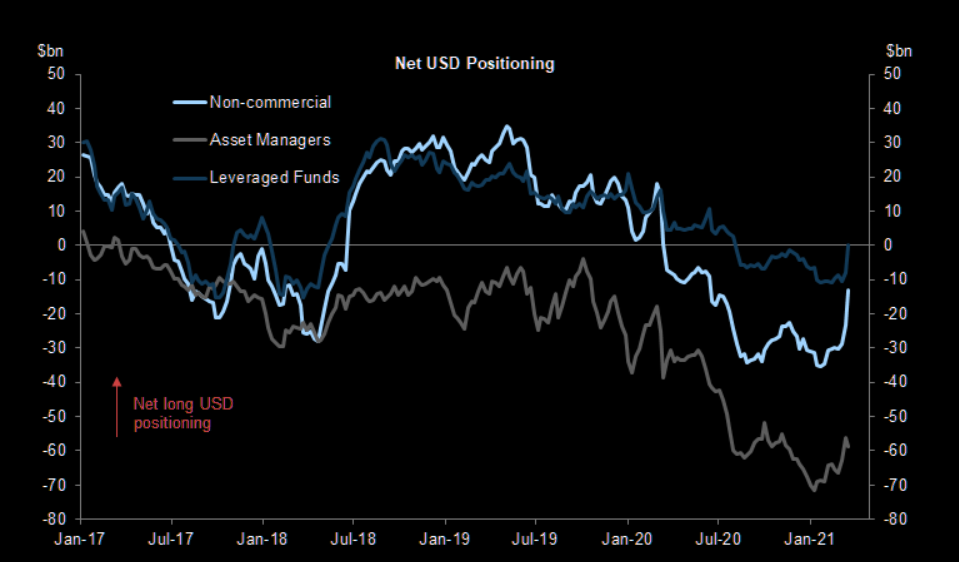

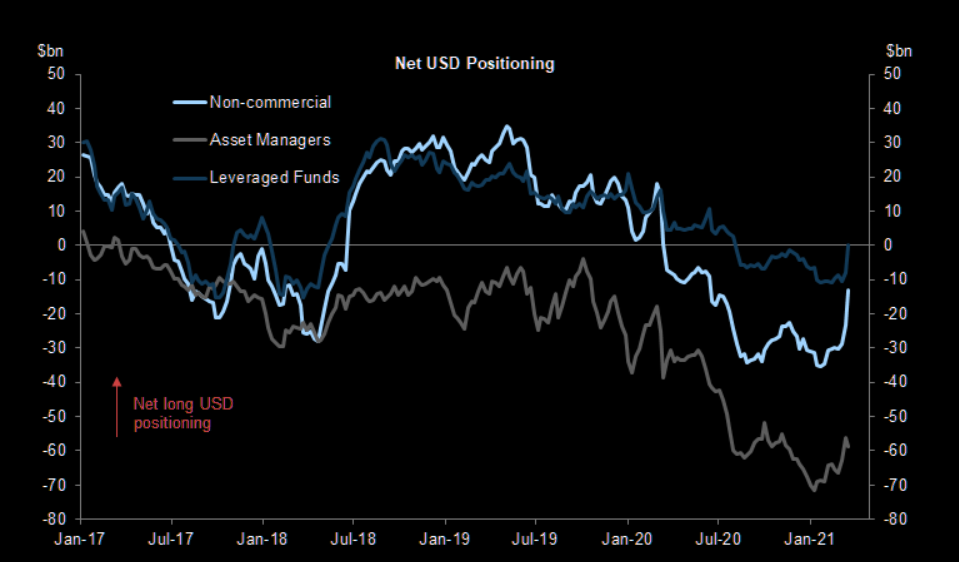

As mentioned in my previous Global Macro Insight, markets have three Damocles swords over their heads: Short Dollar, Short Volatility, and Long US 10Y… Our positioning has been long dollar since the beginning of the year. Now, the short dollar is imploding. I am...

by Jacques Lemoisson | Mar 13, 2021

As mentioned previously, Taïwan is one of the hottest geopolitical spots in the world. Hong Kong is also in this category after G7 expresses ‘grave concerns’ over electoral changes. We could unzoom and consider all the China Sea as the worrying...

by Jacques Lemoisson | Mar 10, 2021

NASDAQ buyers don’t seem interested in this news. Apple had misjudged demand for both the iPhone 12 Pro and the iPhone 12 mini but who cares and wall street analysts won’t just look in this direction. The mildest estimate was that Apple will cut planned...

by Jacques Lemoisson | Mar 2, 2021

Powell will talk during an event hosted by the FT on Thursday. The same day, one of the biggest political events will start in Beijing. Known as the “two sessions”, or lianghui, the annual gatherings of the Chinese People’s Political Consultative Conference (CPPCC)...

by Jacques Lemoisson | Mar 2, 2021

Agree!!! And the comments are echoing those from Lou Jiwei, former minister of finance highlighted in my Global Macro Insight of yesterday. China’s top banking regulator said he’s “very worried” about risks emerging from bubbles in global financial markets and the...

by Jacques Lemoisson | Feb 27, 2021

Let me be clear about ETF. ETF should stay a passive investment vehicle. I started to build asset allocation via ETFs 15 years ago for Pension and Insurance funds. I always advocated that “smart” beta ETF could be dangerous, misleading investors in a kind...