The Macro Blog

Our most recent publications:

Tesla invested $1.5bn in BTC (+11% on the news) and ready to accept for payments…

The future is shaping fast under our eyes.... Asset Allocation without alternative assets would be laggards if these kinds of news occur too many times!!

Renaissance Hit With $5 Billion in Redemptions Since Dec. 1… Syntax Error…Not good for Markets

Renaissance’s Institutional Equities Fund, the biggest of the external vehicles, lost 19% in 2020, the letters show. That fund got the biggest chunk of the redemptions. The Institutional Diversified Alpha fund dropped 32% and the Institutional Diversified Global...

After Jack in the Box, Taxes in the Box for Robinhood traders.

The brokerage industry added over 10 million new retail accounts in 2020, a record year, according to analyst Devin Ryan of JMP Securities. A large number of these were taxable accounts. Robinhood Markets Inc., which brought a flood of first-time traders into the...

Not all Americans are Robinhooders! An explanation for a lower consumption

Uses for the stimulus payments varied by age group. About 54% of people between the ages of 25 and 39 reported on the Census survey that they mostly used the stimulus money to pay off debt, and 26% said they mostly saved it during the Jan. 6-18 period. By comparison,...

Larry Summers (Democrate) pointed out the inflation risk due to a too generous Fiscal Plan

Lawrence Summers, who served as Bill Clinton’s treasury secretary and Barack Obama’s top economic adviser, warned that Biden’s plan was excessive and that it might trigger “inflationary pressures of a kind we have not seen in a generation, with consequences for the...

Senate approves budget resolution… Now, bipartisan deal or not?

Once the House passes the same version of a budget measure, the chambers can move forward with writing a rescue package that is expected to include stimulus checks, a supplemental jobless benefit, and Covid-19 vaccine and testing funds, among other measures. Approval...

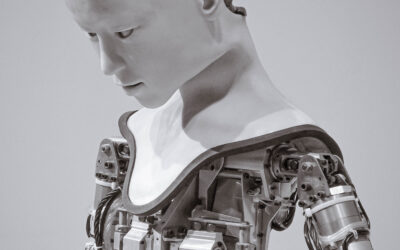

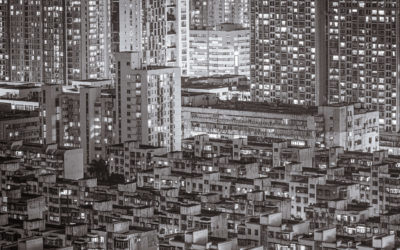

Cutting debt is imperative for Evergrande to meet Beijing’s tough new leverage policy for property developers.

I am still confident in China as the main exposure in my asset allocation. But this trust doesn't prevent us of control regarding some issues. As I wrote many times, Real Estate is the collateral of Chinese economical growth. Evergrande is a prime example of the...

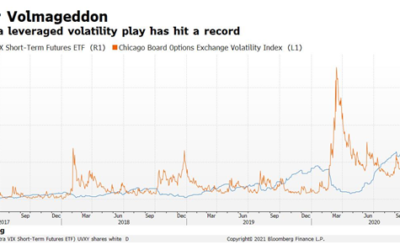

Pay attention to the biggest short squeezes : short USD and short Volatility…

The number of shares outstanding in the ProShares Ultra VIX Short-Term Futures exchange-traded fund, which is essentially a leveraged bet on the increase in U.S. equity volatility, surged to a record last month and remains elevated while the ETF has ballooned to $1.6...

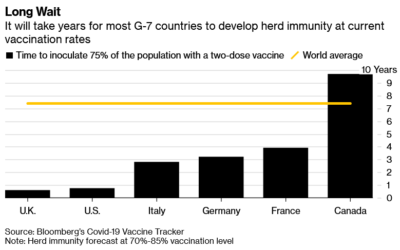

U.S., Israel Years Ahead of Europe in Early Race for Covid Shots… Don’t believe into Politicians’ promises advocating complete herd immunity in Summertime…

Though overall the U.S. is faring relatively well compared with other countries, the picture varies by individual states. Hawaii is headed for the key coverage level this year, with New York currently looking at summer 2022. Of course, we will have acceleration but...

World faces around 4,000 COVID-19 variants… Good to know when States play “all in” on Vaccines…

Thousands of variants have been documented as the virus mutates, including the so-called British, South African, and Brazilian variants which appear to spread more swiftly than others. British Vaccine Deployment Minister Nadhim Zahawi said it was very unlikely that...

Global Macro Insights

Subscribing to our daily Global Macro Insight is the best way to join the club of Global Macro Insiders, far from the noise of fake news and opinions biased by conflicts of interest.

You can choose your subscription type and pay semi-annually or annually (10% discount) via invoice.