House of cards for some, the Lemming effect for your scribe.

Fundamentally everybody we speak to remains a dollar bear. This trade has worked well ever since the Fed March panic and the long term logic remains intact. The DXY is basically trading at mid December levels.

Note the DXY has traded perfectly inside the short term negative trend channel since the rotation started in November. We are actually seeing the DXY put in the biggest up candle in a while today. Note the RSI has been diverging to the upside lately as well. Watch closely should the DXY decide breaking above that short term trend and start pushing above the 21 day moving average, currently around 90.15.

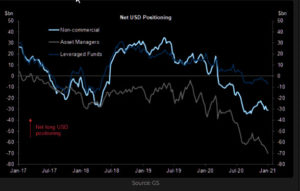

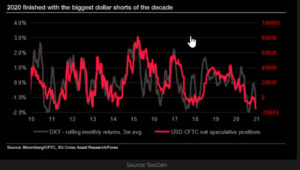

After all, dollar shorts have been piling into the trade and are at decade lows

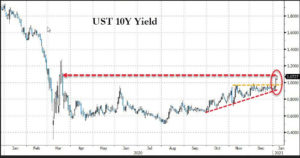

The same regarding the US 10Y, Hedge funds are long due to the arbitrage with Futures gettinig cheap cash for their leverage, Mutual Funds are massivelging y long too due to the regulation forcing them to “manage” bigger liquidity buffers that they invest in Treasuries, and Trend following funds are front running the FED…

We will see how the market will react if the USD comes back to 1.18 vs Eur and the 10Y Yield reaching 2%…