Our specificity at GATE Advisory is to link Geopolitics and investments.

As mentioned in our Outlook 2021, the Global Supply Chain already imploded in 2018, due to US Tariffs, and this move was accelerated and amplified by the current pandemic.

Volkswagen said last month that the bottlenecks meant it would produce 100,000 fewer cars in the first quarter of the year at sites in Europe, North America, and China because its parts makers Continental and Bosch have struggled to secure supplies from their contractors.

Honda also said it plans to cut production for certain car models in the coming months due to a chips shortage caused by a post-pandemic surge in consumer electronics demand.

Bosch, the world’s largest car-parts supplier, said it was receiving “significantly fewer” chips for the components it manufactures, while Dax-listed Continental said there was “extreme volatility” in motor supply chains. France’s Valeo also said it was seeing shortages in the market.

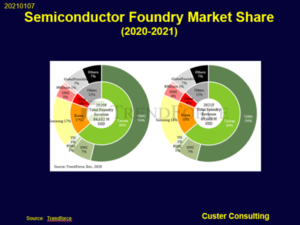

All these announcements are inflationary but the most important is who controls the upstream controls the supply chain. The chart below confirms that TSMC is the diamond of Taiwan.

China wants to take the control of TSMC and the USA doesn’t want that… If Trump is forced to cool down his call to a civil war in the USA, he will continue to hurt China as much as he can.

The last idea was to send the United Union US ambassador to Taiwan…

If you want an example of the correlation between geopolitics and investments, watch out Taiwan!