I am still confident in China as the main exposure in my asset allocation. But this trust doesn’t prevent us of control regarding some issues. As I wrote many times, Real Estate is the collateral of Chinese economical growth.

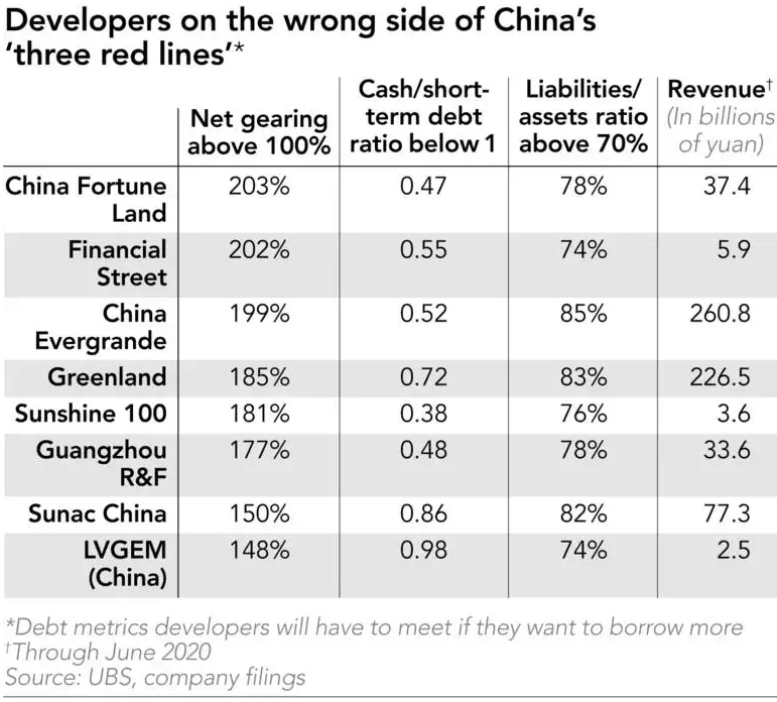

Evergrande is a prime example of the debt-fueled expansion espoused by Chinese companies as the economy grew. Nonfinancial corporate debt climbed to 159.1% of the gross domestic product in the first quarter of 2020 from 152.2% a year earlier, according to the Institute of International Finance. The ratio is the world’s second-highest behind Hong Kong. And I am really concerned about HK.

Entering 2021, the next hurdle for Evergrande seemed to be the maturity of the HK$16.1 billion bonds on Feb. 14. The bond was, theoretically, convertible into Evergrande equity — but at a price far above its depressed share price.

As speculation swirled on how Evergrande would meet the redemptions, it surprised with the pledge to repay and cancel the bonds on Feb. 10. Its shares soared 16% on Jan. 18.

Of the 59 developers with a high-yield rating as of Dec. 31, 11 had weak liquidity, Moody’s Investors Service estimates. Two hundred bonds issued by China developers defaulted in 2020 up from 150 in 2019 and as many as 499 real estate companies went bankrupt last year, according to a report dated Jan. 28 by Daiwa analysts Cynthia Chan and Jonas Kan.