The Macro Blog

Our most recent publications:

Positioning stronger than Fundamental? Just a Question of Temporality.

Some extracts: To be clear, your scribe believes that we are almost at the dawn of the October rally and that, given the extreme positioning of shorts, fundamentals will not carry much weight. For the record, our Global Macro's two best performances in yesterday's...

Decision Time Coming Soon! China Bounce, Reallocation in Equities, and Zurich as example of the Supply Choc!

Some extracts : The three most important facts for China, which the Western media and analyses do not relay, are : The relaxation, or even disappearance, of the hukou. The institutionalization of financial flows following the launch of private pension funds in...

All the best for this new challenging year 2023!

If 2022 was challenging, the new year should keep the tone. We thanks our clients for their trust. Our Global Macro strategy reached 43.89% in 2022, and every day our Global Macro Insight paves the way for our clients, helping them to navigate this complex new...

Our Outlook 2023 (FR&EN)- Point Break : Inflation & Desynchronization

Outlook 2023 AN Outlook 2023 FR

Special Report! Inflation/Ukraine de-escalation ====> TIME to INCREASE EXPOSURE in CHINESE ASSETS and OUR THEMATIC!!!!!!!!!!!!!

Our Global Macro analysis over the past few months seems relevant. As a preamble, the de-escalation in Ukraine is the work of Russia, confirming my comments yesterday in our Global Macro Insight. The USA is now the only one to gesticulate in the zone. Geopolitical...

Simple charts explaining why investors would better play the Decarbonization in China than Consumption

If consumption will likely recover rapidly once lockdowns are lifted, the impact on production and supply chains will likely be manageable. In 2020, travel restrictions were imposed when most people had already returned to their hometowns to celebrate the Chinese New...

Our Outlook 2022 – A New Era getting Real!

Enjoy the ride! Outlook2022 AN

The last addition into our Global China Thematic universe: Healthy China 2030

Let me introduce the last thematic completing our Global China Thematic universe: Healthy China 2030 Key takeaways Fully aligned with the current 5-year plan and its $600bn of investments China’s healthcare equipment market CAGR of 13.6% Traditional Chine Medicine is...

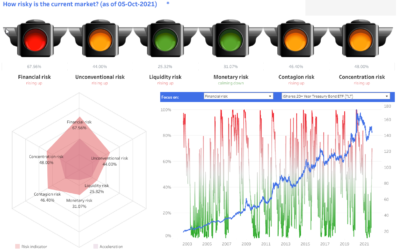

Our proprietary Quantamelental Macro Indicators are flashing!

It seems that markets are ignoring some risks ....

Beijing prepares to build airport on reclaimed land near Taiwan

Mr. Market is only concerned by Central Banks, no clue about Delta variant and geopolitical tensions. When Powell advocates for transitory inflation, China is closing ports, and the Taliban are taking control of Afghanistan, which is depicted by an internal memo from...

Global Macro Insights

Subscribing to our daily Global Macro Insight is the best way to join the club of Global Macro Insiders, far from the noise of fake news and opinions biased by conflicts of interest.

You can choose your subscription type and pay semi-annually or annually (10% discount) via invoice.