Our Global Macro analysis over the past few months seems relevant. As a preamble, the de-escalation in Ukraine is the work of Russia, confirming my comments yesterday in our Global Macro Insight. The USA is now the only one to gesticulate in the zone. Geopolitical issues are not settled. I still believe that a Finnish-style status could be applied to Ukraine…

The 1.2tn$ of share-buybacks are very present, added to the record inflows on equities over the last 4 weeks.

In line with my analysis on inflation in China, the base effect continues to work and, this morning, the Chinese PPI fell below the +10% mark.

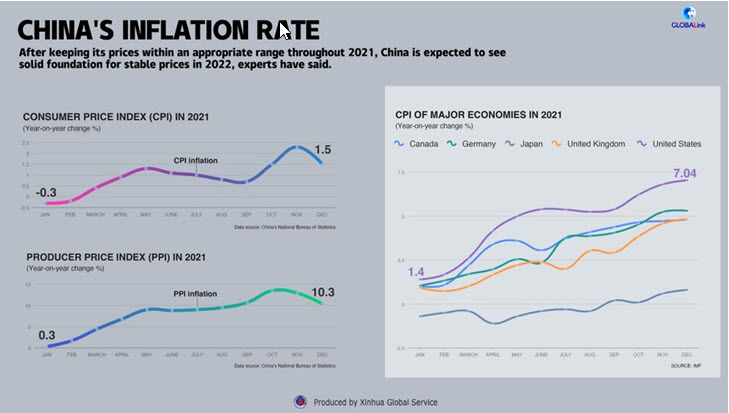

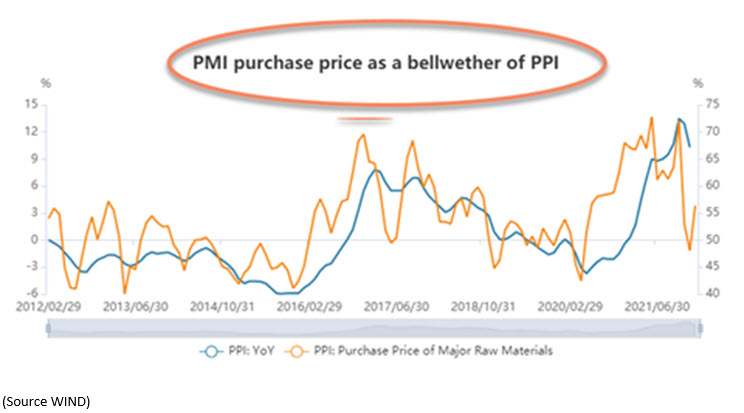

The two important charts to understand inflation in China are:

CPI in China fell to +0.9% YoY in January (from +1.5% YoY in December), mainly due to a strong food price base. The PPI fell to +9.1% YoY in January from +10.3% YoY in December, mainly on a high price basis in the upstream sectors. Year-over-year, I expect the CPI to remain subdued and the PPI to continue to decline in the near term (see the first chart above).

If inflation can be seen as a sign of slowing Chinese growth, this fall is a mirage. If supply chains have improved, China’s 0-Covid policy and the possible rebound in US consumption due to rising wages will leave inflation on a very high diet.

This also means that the FED might not be as aggressive as the strategists say, knowing that in 2021, these same strategists estimated inflation was transitory… The fall in inflation in China (even artificial) will allow the PBOC to have more leeway to implement its accommodative policy.

THE CURRENT ENVIRONMENT MILITATES FOR A TECHNICAL REBOUND INDEXES IF WE CONSIDER THE USA AND THE BEGINNING OF A MEDIUM-TERM BULLISH TREND FOR CHINESE ASSETS. THIS REBOUND MUST BE USED, PRECISELY, TO MAKE ARBITRATIONS:

- GLOBALLY AND PARTICULARLY IN THE USA, LEAVING PURELY INTERNET AND AMERICAN TECH STRATEGIES AND INDEXES (of the ARK type) TO ENTER OUR GLOBAL SPACE AGE THEMES, US INFRASTRUCTURES. THEMES ON INDUSTRY 4.0 ARE THE FUTURE.

- STRONGLY INCREASE EXPOSURE TO CHINA ON THEMES OUTSIDE THE INDEXES SUCH AS OUR CHINA DECARBONIZATION 2060, CHINA HEALTH 2030, and CHINA ROBOTIC. CHINA REMAINS THE ONLY COUNTRY TO IMPLEMENT AN ACCOMMODATING MONETARY POLICY AND OFFER VISIBILITY IN INVESTMENT.

- OUR GTO HAS JUST EXCEEDED THE +10% BARRIER. AS WRITTEN IN OUR GMI OF LAST FRIDAY, WE CUT THE VIX, and ON MONDAY WE ADDED A LINE IN MSCI RUSSIA ETF. WE WILL RETURN SHORT IN THE NASDAQ SOON WHEN THE FINANCIAL COMMUNITY WITNESSES THE EXTREME FLATTENING OF THE YIELD CURVE IN THE US CORPORATE MARGINS FROM HIGHER WAGES WILL BE VISIBLE.

WE HAVE BEEN A LEADER IN POSITIONING IN INFLATION AND CHINA. THE ARBITRATION WE ADVISE IS DICTATED BY OUR MACRO APPROACH AND THE MARKET ENVIRONMENT ANALYSIS.

WE ARE AT YOUR DISPOSAL FOR ANY DETAILS ON THE THEMATIC ALREADY LAUNCHED AND THOSE THAT WILL INTEREST YOU.

Best

Jacques Lemoisson