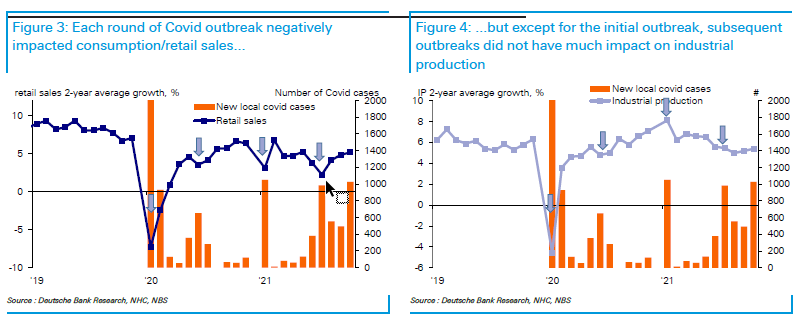

If consumption will likely recover rapidly once lockdowns are lifted, the impact on production and supply chains will likely be manageable.

In 2020, travel restrictions were imposed when most people had already returned to their hometowns to celebrate the Chinese New Year. Many could not go back to work in time post the CNY, causing production to slow or halt. This will not be repeated.

Omicron outbreaks are significant downside risks for near-term consumption demand. Restrictions will likely be imposed nationwide to reduce travel before the Chinese New Year and encourage people to stay where they are.

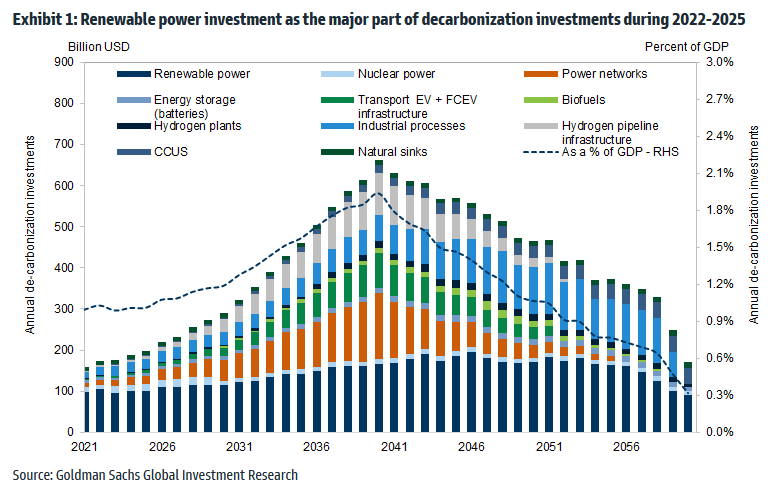

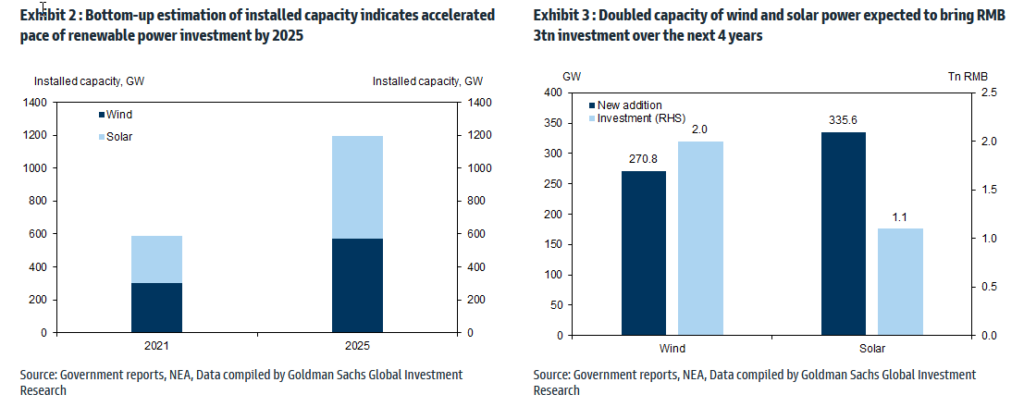

Goldman equity research team estimates that renewable power investment, which mostly consists of wind and solar power investment, will be the majority (55%) of China’s decarbonization investment over the next four years, accounting for around 0.6% of nominal GDP per year in 2022-2025.

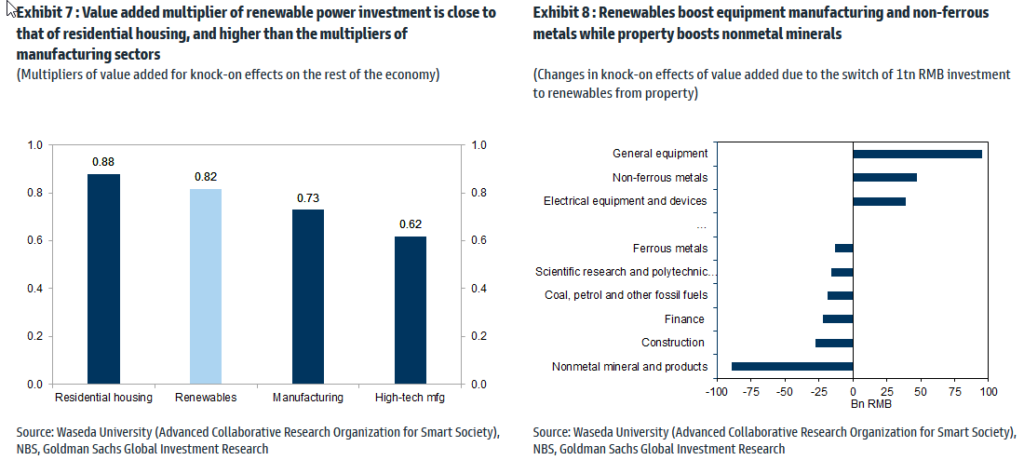

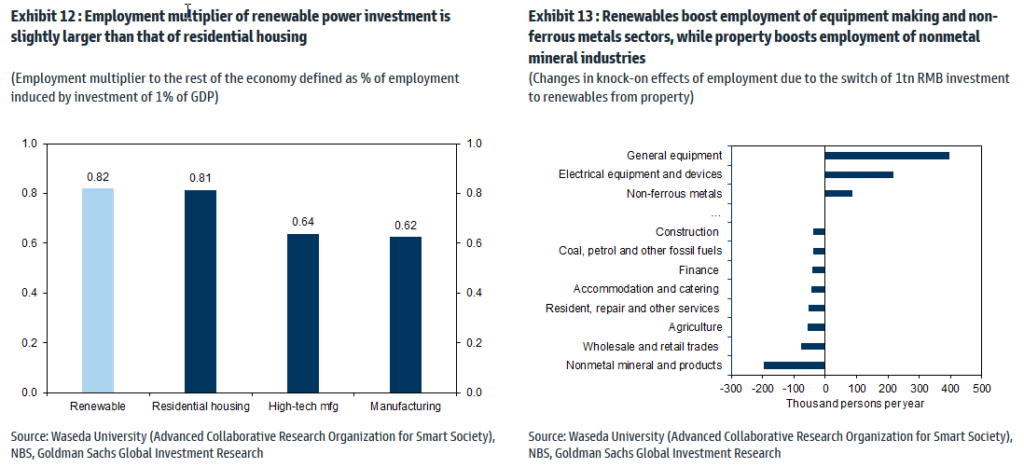

The boost of economic growth from knock-on effects from renewable power investment is comparable with that for residential property investment. If China initially invested 1% of nominal GDP in renewables, it would trigger additional gross value added (GVA) up to 0.82% of nominal GDP. The amount of additional GVA triggered by property investment would be 0.88% of nominal GDP. This implies that if the size of investment in renewables was comparable to that of property, renewable power investment would become an important growth engine.

As emphasized by the government’s “six stabilities, six guarantees” policy focus, labor market stability is the top concern of China’s policymakers. Switching to renewable investment has a couple of effects through two channels: 1) on the aggregate level, the total number of jobs created from renewable energy investment is similar to property investment, after taking into account their respective supply chains; 2) on the distribution of jobs, however, there will be winners and losers from the switch across various sectors.

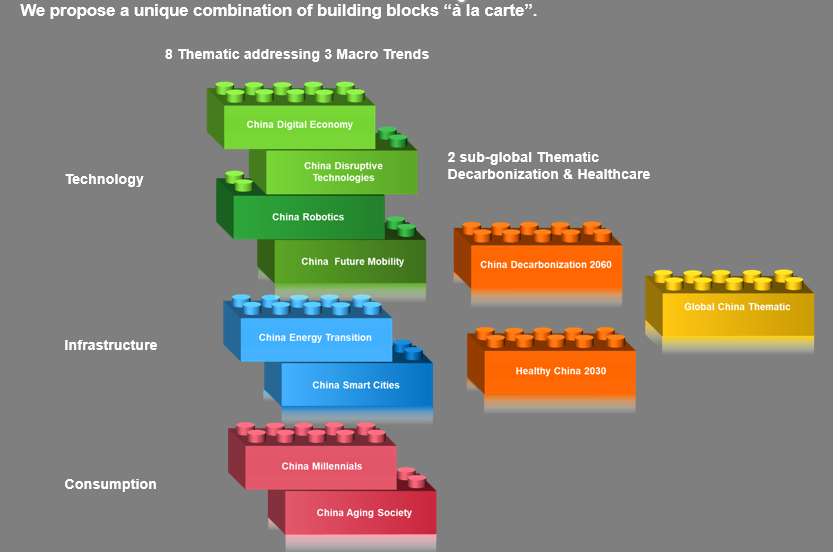

We designed our China Decarbonization 2060 in 2020 and now, the Chinese policy will feed our thematic.

We are among the sole investment company proposing building blocks to concrete your asset allocation in China.

Best

Jacques Lemoisson