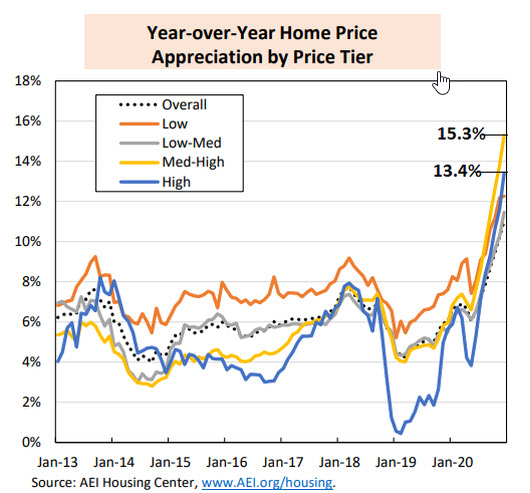

The chart is clear and if you consider that there is no inflation, I can’t argue more.

Powell said :

“The housing sector has more than fully recovered from the downturn,”

“a one-time shift in demand that we think will get satisfied, also that will call forth supply,”… “those price increases are unlikely to be sustained.”

Some observers raise questions about the necessity to pursue the MBS purchase program… Anyway, if the housing market recovered, globally the Real Estate market is not in great shape: hotels, offices, and malls are empty. The bomb of unpaid (or unrecoverable) mortgage and rent fees is becoming huge.

Summing up the situation by only the supply/demand is mystifying the truth. The uptrend of prices is just fueled by the monetary policy. In addition, if you don’t properly measure the explosion of the housing prices in the inflation, you can keep rates low forever…

And Powell is wrong twice. His monetary policy will generate inflation (but the bad one) and he is fueling the uptrend of the housing market. And in addition, housing prices can jump with no end in sight, houses becoming simple financial assets between the hands of happy few, till they can leverage their wealth at zero %…

A bubble is not a question of price mismatch but a value mismatch… And now across all assets, we have a value mismatch, prices are completely disconnected from the intrinsic value of the assets.

Example? The market cap of Tesla is higher than all historic carmakers; Italian and greek govies are yielding below the US 10Y; Deepest recession over decades due to the pandemic and Financial assets on all-time highs when the majority of people are not able to cover 1000$ of spending, etc…