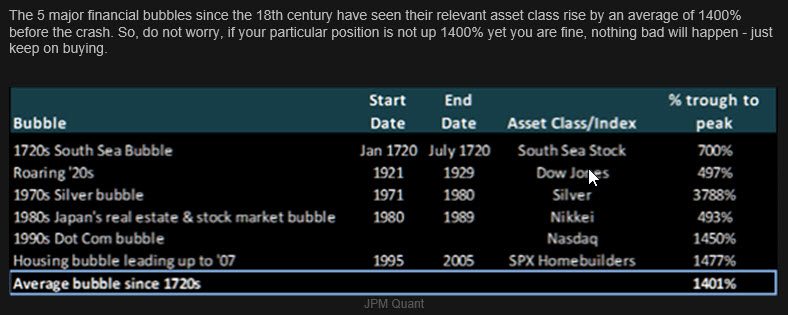

The 5 major financial bubbles since the 18th century have seen their relevant asset class rise by an average of 1400% before the crash. So, do not worry, if your particular position is not up 1400% yet you are fine, nothing bad will happen – just keep on buying.

Our Global Macro strat, GTO, is up +0.83% YTD. We flipped our short Nasdaq /Long Russell 2000 last week. We are still short in European Assets, long Chinese equities, but regarding the US, we are now long TECH and short US Banks.

The JPM QUANT tab is interesting in the current environment. Short are killing famous hedge funds. Melvin since its 2014 founding has returned an average of 30% a year.

But, Citadel and Point72 Asset Management are investing $2.75 billion into hedge fund Melvin Advisory, which has been hard hit by a series of short bets to start the year. The influx of cash is expected to help stabilize Melvin, which in 2021 has lost 30% through Friday, said people familiar with the firm. Melvin started the year with $12.5 billion.

Our Barbell approach is pretty interesting in this environment. Any investor with a minimum of common sense is not comfortable. Investors, Central Banks, Governments are “all in” at all stages.

The Retail Army is buying its weekly options (that’s why US indices are negative every Friday), we think that markets are under control due to Central Banks’ interventions, we think that we control economic growth due to government spending, we think that we control our societies due to populist president and social media, and we think that we control the death due to DNA research and augmented human projects… But in fact, we control nothing, the virus is controlling us.

Markets have enough fuel to fly higher in an even lower oxygen environment. The short covering from Hedge Funds could be the spark for the last up leg. Trust me, one day we will fall hard, but markets need to realize the temporality gap between what they paid and the reality.

Three topics could end this sweet dream initiated in 2009 :

- Inflation

- Covid strain resisting vaccines

- Too slow-motion vaccination campaigns